Changes To ICBC No-Fault Benefits

Regardless of whether you are at fault for an accident, ICBC will provide you with no-fault benefits (also called Part 7 benefits). These benefits include medical and rehabilitation expenses, wage loss, housekeeping expenses, and death benefits.

Significant changes to no-fault benefits came into effect on April 1, 2019. Although ICBC has increased the benefits it will pay, it may become more difficult to obtain these benefits. Therefore, we recommend that you speak to a lawyer to discuss your rights and obligations.

Medical and Rehabilitation Expenses

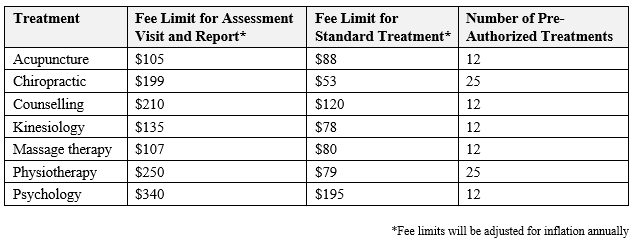

As of April 1, 2019, ICBC has increased its coverage for certain treatments and will pre-approve a certain number of treatments (you do not need approval from an adjuster). These changes apply to all existing and new claims, regardless of the date of the accident. See the below table for ICBC’s new rates:

If the cost of the treatment exceeds the fee limit, you must pay the remainder of the treatment cost, called a “user fee.” ICBC will not reimburse you for user fees during your claim. For accidents on or after April 1, 2019, you cannot claim user fees at the end of your case.

If you reach the maximum number of pre-authorized treatments or if it is more than 12 weeks after your accident, you must obtain a note from your doctor recommending additional treatment. If you do not, ICBC will not fund further treatment.

The lifetime limit for all medical and rehabilitation expenses has increased from $150,000 to $300,000 for accidents occurring on or after January 1, 2018. However, very few people will ever reach this limit (only about 40 per year in the entire province).

Wage Loss Benefits

If you are unable to work due to your injuries, you may be entitled to wage loss benefits (also called TTDs) from ICBC. TTD benefits are equal to 75% of your average weekly earnings in the year before the accident, up to a maximum amount.

As of April 1, 2019, the maximum amount for TTD benefits has increased from $300/week to $740/week. This only applies to motor vehicle accidents that occur on or after April 1, 2019.

Before you can receive TTD benefits, you must first apply for any other wage loss benefits available to you, including EI sickness benefits, short/long term disability benefits through a private insurer/employer; or sick bank at work. If you are eligible for TTD benefits, you will likely be entitled to EI sickness benefits (paid for up to 15 weeks). Once your other benefits run out, then you can receive TTD benefits.

Also, if you receive other disability benefits or EI sickness benefits and those benefits are less than 75% of you average weekly earnings, ICBC may pay you a TTD “top-up” to increase your total benefits to 75% (the same limits above apply to TTD “top-up” payments).

Homemaking Benefits

If you do the majority of the housekeeping for your family and your injuries prevent you from performing most of your household tasks, ICBC may cover the cost of hiring someone (not family) to perform the household tasks.

As of April 1, 2019, the maximum coverage for homemaking benefits increased from $145/week to $280/week. This only applies to motor vehicle accidents that occur on or after April 1, 2019.

Death Benefits

If a person dies as a result of a motor vehicle accident, ICBC will cover a portion of funeral expenses and pay death benefits to certain surviving family members.

As of April 1, 2019, coverage for funeral expenses increased from a maximum of $2,500 to $7,000. Death benefits have also increased and will be paid to more types of family members. The death benefit is now $30,000 for spouses and $6,000 for dependants.

If you have any questions regarding the benefits available to you or require assistance in obtaining benefits from ICBC, please contact us at 604-284-5633.

9 April 2019

Ryan Chew, J.D., Chouinard and Company